Written by Lyndon, posted Feb 28, 2024

Every Tax season I get flashbacks to when I was a kid at my grandma’s house. It was around the end of the month and my grandma had just gotten her bank statement in the mail and she was balancing her checkbook. I had to ask what this meant, she was going line by line comparing every transaction in the bank statement to what she had spent from her checkbook (she’d worked as a bookkeeper years earlier). She would spend hours chasing down why the numbers were off by pennies, and digging through bills in her filing cabinet to figure it out – I’m pretty sure her personal finances were more organized (and documented) than many businesses…

As a business owner sometimes tax season feels like this, going line by line trying to figure out what every expense from the last year was and how to categorize them into the IRS’s seemingly arbitrarily defined categories that we can deduct from our income.

A few years ago we switched our business banking & expense tracking to Found, and it’s made tax season way less stressful by making it “easy” to track, document, and estimate everything throughout the year, so that come tax season we don’t have to go line by line through every card swipe of the year scratching our head’s asking, “what it was actually spent on?”

What is Found?

If you’ve never heard of Found, it’s an All-In-One banking application specifically designed for the needs of self-employed people and small businesses. It combines banking, expense tracking, estimating & pre-paying taxes, reporting, and invoicing to list out a few that we’ll be looking at below.

How does it fit into our Biz?

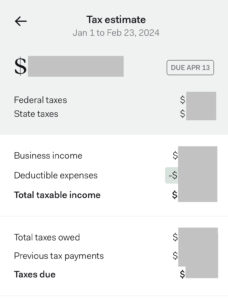

Right now for simplicity, our business is set up as a single-member LLC that we file taxes as a pass-through entity on our joint tax filing. Part of setting up our Found account was entering all this information along with our estimated income and any adjustments/deductions/credits so that Found could estimate taxes correctly for us.

Found is where all our income lands once deposited from Honeybook (our CRM), stripe/Stan.store, or even PayPal payouts (affiliate income). This builds the income top line of the reports and tax estimates, it is also possible to manually add income activity that never deposits into this bank account.

When Found first started everyone had 2 pockets for money, Primary & Taxes (which I talked about in our original review after using Found for 5 months). Now you can create more pockets, set up automation for where your money goes when income is deposited, and even set up dedicated virtual cards for paying out of specific pockets.

Yup – I “borrowed” this fancy graphic from Found’s website, I’m not smart enough to make a graphic this cool

We have a Primary pocket where most money lands, a Savings pocket where we’re building up a rainy day fund, and a Taxes pocket that sets aside money based on what our estimated taxes are. For example, at any time I can go in and see what Found estimates our next quarterly tax payment will be for both federal and state:

But Lyndon we’ve only talked about income, how does it know what deductible expense you have to calculate Total taxable income?

This is where Found sold us originally, expense tracking is built into the application instead of having a separate Quickbooks or Xero application to cross-check with your bank account every month (IYKYK).

In Found this is called Activity – any of your income, any charges to your Found debit card (did I mention you get physical & virtual debit cards?), anything you want to manually add in, and my personal favorite imported transactions.

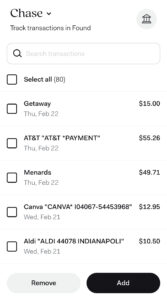

As a credit card points & perks stan, I always default to using a credit card. It’s a seamless process to connect our credit cards and then import our work transactions, and not import those “accidentally” mixed-in personal charges, into the activity stream (paid Plus tier Feature).

And yes if we “accidentally” added our trip to Menards to Found since we posted an IG story there, and then realize it’s probably not accctuualllly a “work expense” we can remove an imported transaction, or mark it as personal so it won’t count towards our biz expenses.

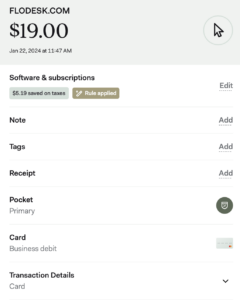

Once everything is in our Activity list we can now add a category, purpose, receipt, and tags.

The bare minimum is every expense needs a category, and from there Found will prompt us for which expenses need a purpose (eg meals, travel) and a receipt (eg: over a threshold or certain categories). For receipts, you have the option to upload a receipt, directly take a photo in the app, or mark that you have it stored in your records.

Having correctly categorized expenses is how Found calculates our taxable income, the purpose & receipts are all about documentation in case we ever get audited (read: sleep better at night).

None of this is actually that different than using an expense tracker .. except it’s all in one place and so much easier that it’s not a pain to stay consistent with.

I’ll usually go in a couple of times a month to import our transactions that weren’t paid directly from Found and make sure that everything gets categorized correctly. For a lot of recurring expenses I’ve created custom rules so as soon as the activity is recorded it applies the category (the free plan only includes a limited number of custom rules):

The key here is it’s quick & easy to stay up to date, whether using the mobile app or desktop website.

Based on these categories, when you get to Tax season at the end of the year Found can output a Schedule C for you to pass on to your tax person or – if you’re crazy like me – to fill out your taxes in TurboTax. It saves a ton of time having everything pre-categorized.

The other cool thing you can do with individual activities is add Tags. These are great for when you have groups of Income &/or Expenses you want to filter or look at together.

Last fall we hosted an in-person workshop and once it was done & all the charges had come in I wanted to look at how all the income & expenses stacked up, so I tagged everything and walked myself over to analytics (read: moved my thumb)

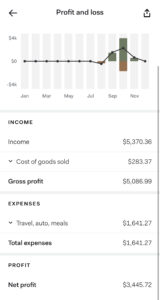

For anyone who read my 5-month review blog, not having reports on mobile was a con, they work nicely now. I can drill down on any of the Income/Expenses to individual activities in case I’d like to see why numbers are lower/higher than expected.

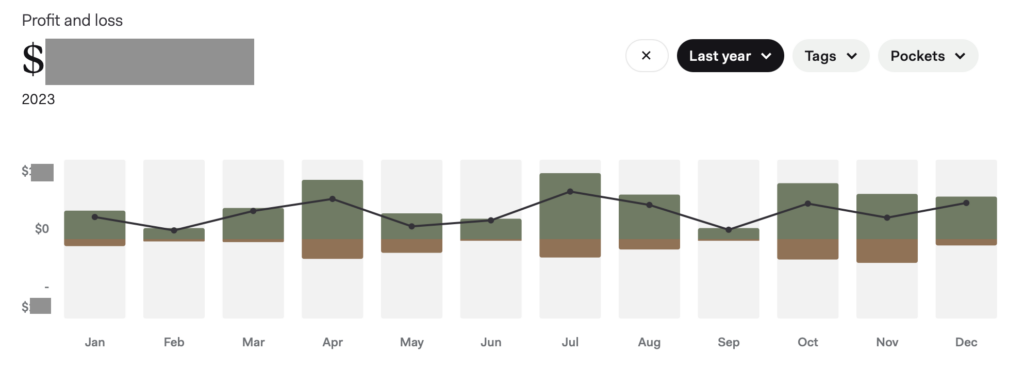

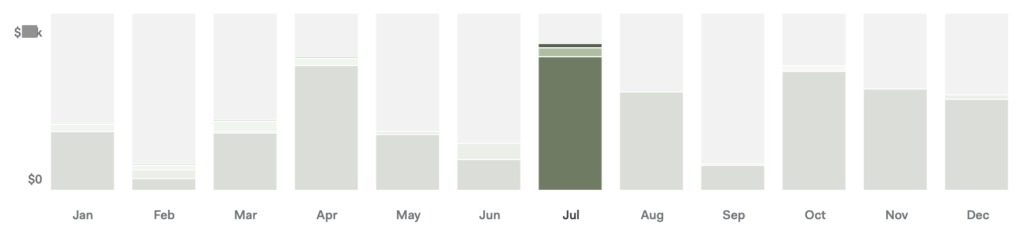

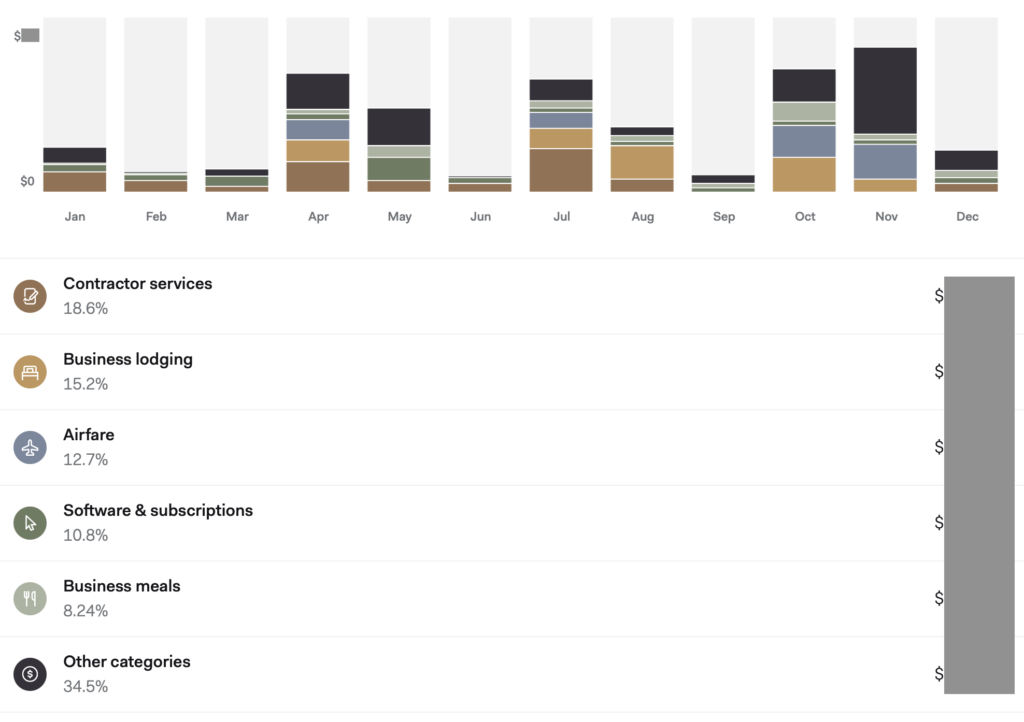

Speaking of reporting, there are three main reporting views that all have the numerical breakdown at the bottom of all the activities that tally up to the totals:

Profit and loss:

Income (you can select one month to filter the numbers below):

Expenses:

Would you believe that we took most of November off work based on these reports? Yea based on these charts, I didn’t either… I dug into those numbers to try and figure out what was up – black Friday equipment upgrades drove up our Nov expenses. Having a visual view of how our business is operating makes high-level overviews so much easier, and then being able to filter down based on Tags or even Pockets 👨🍳🤌

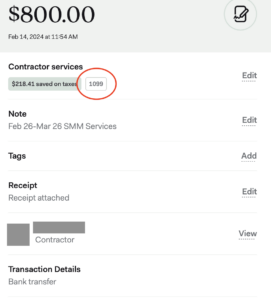

As you may notice, Contractor Services accounted for our single largest expense of 2023 – much of this was invoiced and paid on a credit card – but a little under a quarter of this was 1099 payments. In the past 1099s have been a headache, but Found has some really helpful contractor management features to simplify this process:

When you go in to add a new contractor in Found it allows you to just add in their email address and Found will send them a link to fill in their own W-9 and payment details.

You can then either pay them directly from Found or go in and mark individual Activities as 1099.

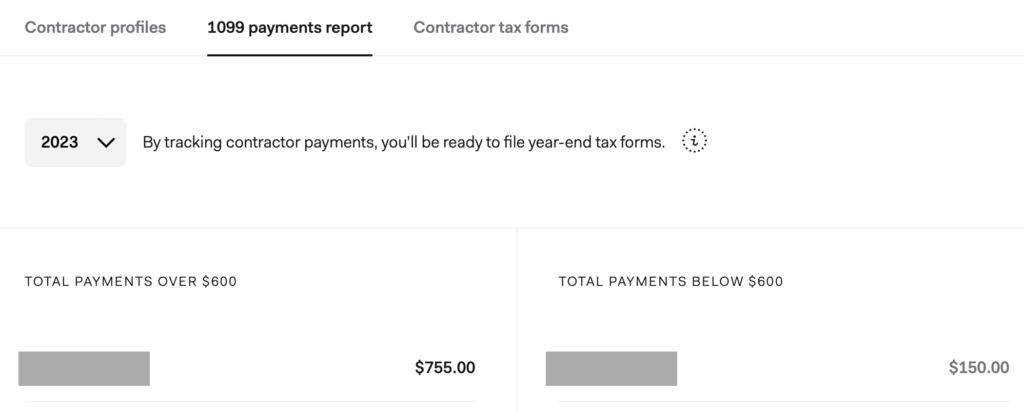

Keeping track of what payments were 1099 throughout the year makes it straightforward in January for us to look at the “1099 payment report” and see who we paid over $600 and then export the contractor tax forms that we then submit to the IRS (Dear Found: if you can find a way to submit these to the IRS as part of a paid plus tier feature that’d be great, thanks)

Worthy mentions while we are talking features:

- You can add access to your Found for your Accountant &/or bookkeeper

- There’s a whole built*-*out invoicing functionality – since we invoice through our CRM it’s simpler for us to do it all in one place

Phew 1500 words later … can you see why we love Found, it’s simplified a lot for us.

But is it worth upgrading from the free tier to the plus tier?

I’d make the argument that it will get pretty close to paying for itself if you’re the type of business owner who keeps a rainy-day fund for your business. Let’s do some quick math – one of the perks of Plus is “1.5% APY on balances up to $20K”, so effectively if you keep an average of $9,934 in found throughout the year you’ll get a balance bonus of ~$149 or the cost of Found Plus. If you’re sitting on more than $20k in a bank account that’s not earning anything, may I introduce you to a HYSA or even investing?

Other features in Plus that I mentioned above make bookkeeping infinitely easier

- Importing transactions from credit cards, or even Venmo or the like

- Unlimited custom categories & rules for activities

- In-app quarterly federal tax payment (for Schedule C filers)

- And one I haven’t personally used but gives peace of mind – Priority customer support

To put plus pricing in perspective compared to major accounting/bookkeeping software:

- Quickbooks’ cheapest option is $30/m or $360/year (2x the cost) but also their banking with 5.00% APY (or 3x what Found has…) so similar pay-off math works for them – I’d argue Found has an edge on features specifically for self-employed or small businesses

- Xero’s cheapest option is $15/m or $180/y so similarly priced, but since they’re don’t offer banking they don’t have an APY to “earn” back the cost of the plan

Okay, we’ve walked through a ton of pros – but it can’t be perfect for everyone?

Found is fairly specific in who they are intentionally building for and who it’s not for. If you’ve got W2 employees/payroll, multiple members in your LLC, or have a bookkeeper with a preferred/required platform – Found is probably not for you.

If you’re the one who manages your finances, gets overwhelmed by the nuances of bookkeeping & tax deductions, or runs your business out of a personal bank account, I’d recommend giving Found a try on their free plan. You can always upgrade to the plus features, but it’s still a great platform on the free plan.

PS: As Found affiliates, we would appreciate you using one of our links if you choose to sign up because it’ll cost you nothing and we’ll get a little affiliate income.

Found’s disclaimer: Found is a financial technology company, not a bank. Business banking services are provided by Piermont Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. The Found Mastercard Business debit card is issued by Piermont Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

Comments +